What are Basel Accords?

The Basel Accords refer to a series of three international banking regulatory meetings that established capital requirements and risk measurements for global banks.

Basically they are a series of three sequential banking regulation agreements (Basel I, II, and III) set by the Basel Committee on Bank Supervision (BCBS).

What is the aim of these accords?

The accords are designed to ensure that financial institutions maintain enough capital on account to meet their obligations and also absorb unexpected losses.

Why the meetings are named “Basel Accords”?

The meetings are named “Basel Accords” since the Basel Committee on Bank Supervision (BCBS) is headquartered in the offices of the Bank for International Settlements (BIS) located in Basel, Switzerland.

What is the Basel Committee on Banking Supervision?

The Basel Committee on Banking Supervision (BCBS) is an international committee formed to develop standards for banking regulation.

As of 2022, it is made up of Central Banks and other banking regulatory authorities from 28 jurisdictions and has 45 members.

The Basel Committee on Banking Supervision was formed in 1974 by central bankers from the G10 countries, who were at that time working towards building new international financial structures to replace the recently collapsed Bretton Woods system.

The committee is headquartered in the offices of the Bank for International Settlements (BIS) in Basel, Switzerland.

What is the Bank for International Settlements (BIS)?

The Bank for International Settlements (BIS) is an international financial institution offering banking services for national central banks and a forum for discussing monetary and regulatory policies.

It is governed by a board elected by the 63 central banks with ownership stakes, with permanent seats reserved for the U.S., U.K., Germany, France, Italy, and Belgium.

Headquartered in Basel, Switzerland, the Bank for International Settlements is often called the “central bank for central banks”.

Basel I

When was the first Basel Accord or Basel I was issued?

The first Basel Accord, known as Basel I, was issued in 1988. The Accord was enforced by law in the Group of Ten (G-10) countries in 1992.

What was the focus of Basel I?

Basel I focused on the capital adequacy of financial institutions. The capital adequacy risk (the risk that an unexpected loss would hurt a financial institution), categorizes the assets of financial institutions into five risk categories—0%, 10%, 20%, 50%, and 100%.

What were the recommendations of Basel I?

Under Basel I, banks that operate internationally must maintain capital (Tier 1 and Tier 2) equal to at least 8% of their risk-weighted assets. This ensures banks hold a certain amount of capital to meet obligations.

For example, if a bank has risk-weighted assets of $100 million, it is required to maintain capital of at least $8 million.

Tier 1 capital is the most liquid and primary funding source of the bank, and tier 2 capital includes less liquid hybrid capital instruments, loan-loss, and revaluation reserves as well as undisclosed reserves.

Basel II

When was the second Basel Accord or Basel II was issued?

A new set of rules known as Basel II was developed and published in 2004 to supersede the Basel I accords.

The second Basel Accord, called the Revised Capital Framework but better known as Basel II, served as an update of the original accord that is Basel I.

What was the focus of Basel II?

It focused on three main areas:

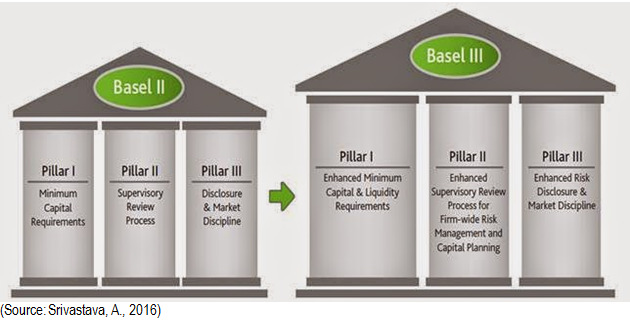

Pillar 1: Capital Adequacy Requirements

Pillar 1 improves on the policies of Basel I by taking into consideration operational risks in addition to credit risks associated with risk-weighted assets (RWA). It requires banks to maintain a minimum capital adequacy requirement of 8% of its RWA.

Pillar 2: Supervisory Review

Pillar 2 was added owing to the necessity of efficient supervision and lack thereof in Basel I, pertaining to the assessment of a bank’s internal capital adequacy. Under Pillar 2, banks are obligated to assess the internal capital adequacy for covering all risks they can potentially face in the course of their operations.

Pillar 3: Market Discipline

Pillar 3 aims to ensure market discipline by making it mandatory to disclose relevant market information. This is done to make sure that the users of financial information receive the relevant information to make informed trading decisions and ensure market discipline.

How Basel II was different from Basel I?

Basel II divided the eligible regulatory capital of a bank from two into three tiers. The higher the tier, the less subordinated securities a bank is allowed to include in it. Each tier must be of a certain minimum percentage of the total regulatory capital and is used as a numerator in the calculation of regulatory capital ratios.

What is tier 3 capital?

The tier 3 capital is defined as tertiary capital, which many banks hold to support their market risk, commodities risk, and foreign currency risk, derived from trading activities.

Tier 3 capital consisted of low-quality, unsecured debt issued by banks before the Great Financial Crisis. What this really means is that banks used loans from other banks to cover any losses they took while trading on several markets.

If the markets collapsed (which they did), the banks would have to cover losses with higher-quality debt such as shareholder’s equity, retained capital, or supplementary capital, draining their accounts.

Tier 3 capital includes a greater variety of debt than tier 1 and tier 2 capital but is of a much lower quality than either of the two.

Under the Basel III Accords, tier 3 capital was required to be phased out starting Jan. 1, 2013, and removed from accounts by Jan. 1, 2022.

Basel III

When was the third Basel Accord or Basel III was issued?

Following the financial crisis of 2007–2008, the Basel III reforms were published in 2010/11.

What was the background of Basel III?

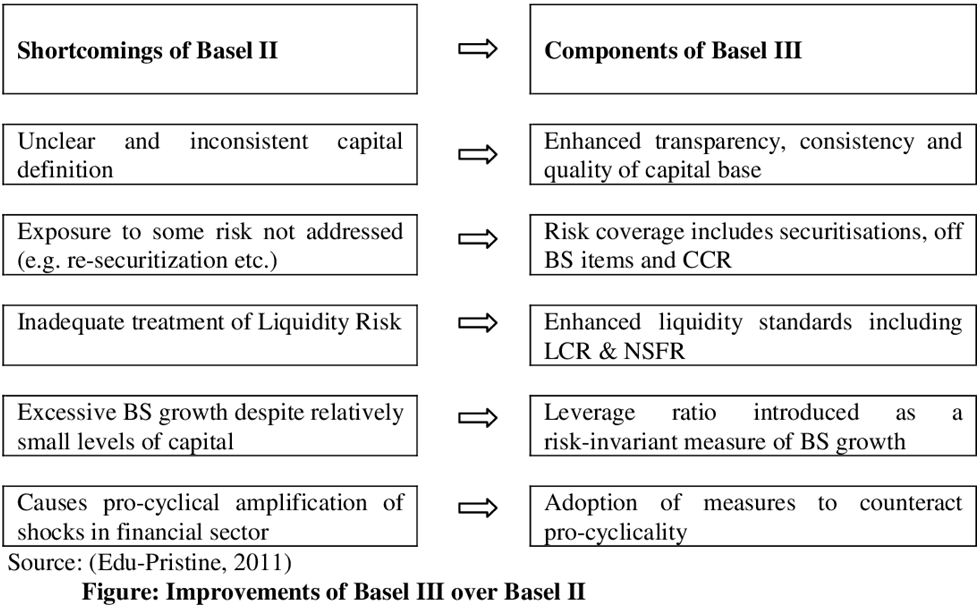

In the wake of the Lehman Brothers collapse of 2008 and the ensuing financial crisis, the BCBS decided to update and strengthen the Accords.

The BCBS considered poor governance and risk management, inappropriate incentive structures, and an overleveraged banking industry as reasons for the collapse.

In November 2010, an agreement was reached regarding the overall design of the capital and liquidity reform package. This agreement is now known as Basel III.

What is Basel III?

Basel III is a continuation of the three pillars along with additional requirements and safeguards.

For example, Basel III requires banks to have a minimum amount of common equity and a minimum liquidity ratio.

Basel III also includes additional requirements for what the Accord calls “systemically important banks,” or those financial institutions that are considered “too big to fail.” In doing so, it got rid of tier 3 capital considerations.

The Basel III reforms have now been integrated into the consolidated Basel Framework, which comprises all of the current and forthcoming standards of the Basel Committee on Banking Supervision. Basel III tier 1 has now been implemented.

The final Basel III framework includes phase-in provisions for the output floor, which will start at 50% on Jan. 1, 2023, rising in annual steps of 5% and be fully phased-in at the 72.5% level from January 2028. These 2023 onward measures have been referred to as Basel 3.1 or Basel IV.

Types of Tier Capital

Tier 1 capital

Tier 1 capital is a bank’s core capital, which consists of shareholders’ equity and retained earnings; it is of the highest quality and can be liquidated quickly.

Tier 1 capital is intended to measure a bank’s financial health; a bank uses tier 1 capital to absorb losses without ceasing business operations.

Tier 2 capital

Tier 2 capital is supplementary capital, i.e., less reliable than tier 1 capital. A bank’s total capital is calculated as a sum of its tier 1 and tier 2 capital. Regulators use the capital ratio to determine and rank a bank’s capital adequacy.

Tier 2 capital includes revaluation reserves, hybrid capital instruments, and subordinated debt. In addition, tier 2 capital incorporates general loan-loss reserves and undisclosed reserves.

Tier 3 capital

Tier 3 capital consisted of subordinated debt to cover market risk from trading activities, but it is now not used in the banks of Basel Accord member countries.

PRACTICE QUESTIONS

QUES . ‘Basel III Accord’ or simply ‘Basel III’ often seen in the new, seeks to: UPSC 2015

(a) develop national strategies for the conservation and sustainable use of biological diversity

(b) improve banking sector’s ability economic stress and improve risk management

(c) reduce the greenhouse gas emissions but places a heavier burden on developed countries

(d) transfer technology from developed countries to poor countries to enable them to replace the use of

chlorofluorocarbons in refrigeration with harmless chemicals

(b)