What is tax-to-GDP ratio?

Tax-to-GDP ratio represents the size of a country’s tax kitty relative to its GDP.

It is a representation of the size of the government’s tax revenue expressed as a percentage of the GDP.

Higher the tax to GDP ratio the better financial position the country will be in.

The ratio represents that the government is able to finance its expenditure.

A higher tax to GDP ratio means that the government is able to cast its fiscal net wide.

It reduces a government’s dependence on borrowings.

Must read: BUDGET TERMINOLOGY

Why is it important?

A higher tax to GDP ratio means that an economy’s tax buoyancy is strong as the share of tax revenue rises in sync with the rise in the country’s GDP.

India, despite seeing higher growth rates, has struggled to widen the tax base.

Lower tax-to-GDP ratio constrains the government to spend on infrastructure and puts pressure on the government to meet its fiscal deficit targets.

Where does India stand among global peers?

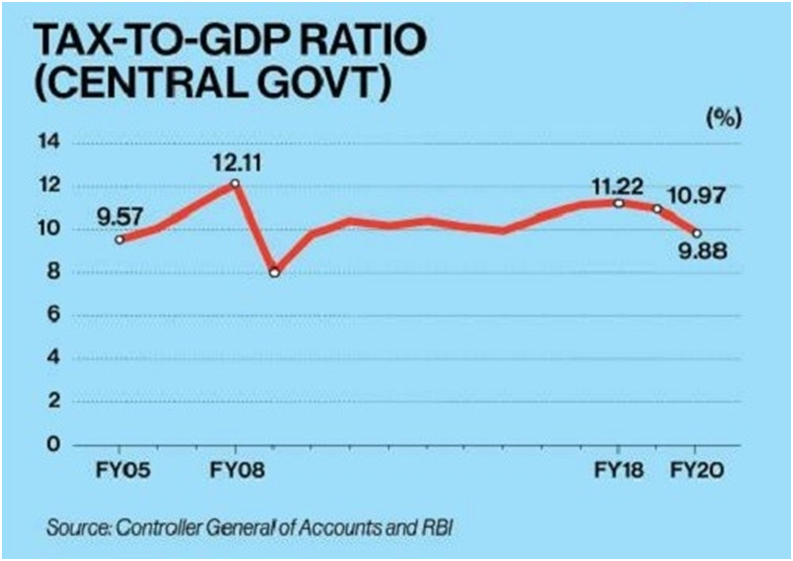

Although India has improved its tax-to-GDP ratio in the last few years, it is still far lower than the average OECD ratio which is 34 per cent.

India’s tax-to-GDP ratio is expected to hit a record high of 11.7% of GDP in 2024-25.

India’s tax-to-GDP ratio is lower than some of its peers in the developing world.

Developed countries tend to have higher tax-to-GDP ratio.

A tax-to-GDP ratio of 15% or higher is believed to ensure economic growth and, thus, poverty reduction in the long term, according to the World Bank.

How can it be improved?

The most important measure for improving tax to GDP ratio is ensuring the citizens pay their taxes.

The introduction of Direct Tax Code can help in greater compliance in this regard.

Rationalisation of GST and moving towards a two-rate structure can also help in increasing compliance and putting an end to tax evasion.

While measures to improve tax compliance and widen the tax base will yield higher tax revenue, the importance of higher economic growth cannot be ignored.

PRACTICE QUESTIONS

QUES. A decrease in tax to GDP ratio of a country indicates which of the following? UPSC 2015

1 . Slowing economic growth rates

2 . Less equitable distribution of national income

Select the correct option from the codes given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

(a) 1 only EXPLANATION: ֍ Policymakers use the tax-to-GDP ratio to compare tax receipts from year to year because it offers a better measure of the rise and fall in tax revenue than simple amounts. ֍ Tax revenues are closely related to economic activity, rising during periods of faster economic growth and declining during recessions. ֍ As a percentage, tax revenues generally rise and fall faster than GDP, but the ratio should stay relatively consistent, barring extreme swings in growth.