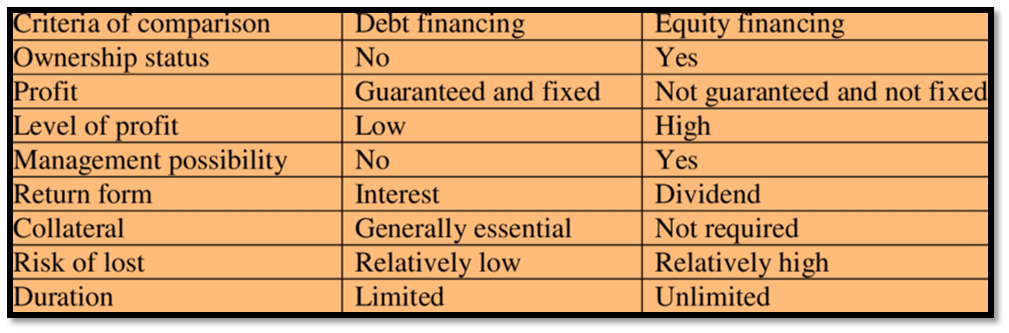

Companies mostly have two types of financing options when there is a question of raising capital for business needs : equity financing and debt financing. Usually companies use a combination of both.

Both debt financing and equity financing are considered as capital expenditures.

What are the factors which determine the choice between debt or equity financing?

Companies have a choice as to whether to seek debt or equity financing. The choice often depends upon which source of funding is most easily accessible for the company, its cash flow, and how important maintaining control of the company is to its principal owners.

What does debt-to-equity ratio of a company shows?

The debt-to-equity ratio shows how much of a company’s financing is proportionately provided by debt and equity.

What is Equity Financing ?

Equity financing involves selling a portion of a company’s equity in return for capital.

Equity finance is comparatively long term finance.

The shareholder of the company is the owner of the company.

What are the common sources of equity financing?

The common sources of equity financing are:

Angel investors ; Corporate investors ; Venture capital firms ; Initial Public Offering (IPO) ; institutional investors ; Crowdfunding , etc.

What are the advantages of equity financing?

1 . There is no obligation to repay the money acquired through it.

2 . Equity financing places no additional financial burden on the company. Since there are no required monthly payments associated with equity financing, the company has more capital available to invest in growing the business.

What are the disadvantages of equity financing?

1 . In order to gain funding, the company will have to give the investor a percentage of the company.

2 . The company will have to share its profits and consult with it’s new partners any time it make decisions affecting the company.

3 . The only way to remove investors is to buy them out, but that will likely be more expensive than the money they originally gave the company.

What is Debt Financing ?

Debt financing involves borrowing money and paying it back with interest.

Debt finance is comparatively short term finance.

Debt financer is a lender to the company.

What is the most common form of debt financing?

The most common form of debt financing is a loan.

What are the common sources of debt financing?

The common sources of debt financing are:

Term loans ; Business lines of credit ; trade credit ; Business credit cards ; Personal loans, usually from a family or friend ; Peer-to-peer lending services ; Invoice factoring ; corporate bonds ; mortgages ; overdrafts

What are the advantages of debt financing?

1 . The lender has no control over your business.

2 . The interest company pay’s is tax-deductible.

3 . It is easy to forecast expenses because loan payments do not fluctuate.

What are the disadvantages of debt financing?

1 . Debt is an expense and company has to pay expenses on a regular schedule. This could put a damper on company’s ability to grow.

2 . The lender may require the company to guarantee the loan with the company private (family’s) financial assets.

3 . Debt financing sometimes comes with restrictions on the company’s activities that may prevent it from taking advantage of opportunities outside the realm of its core business.

Thus , when it comes to financing , a company will choose debt financing over equity, for it would not want to give away ownership rights to people; it has the cash flow, the assets, and the ability to pay off the debts. However, if the company does not qualify in these above aspects of meeting up to the great risk of lenders, they will prefer choosing equity finance over debt.

Must read: Public debt of India – Significant Trends

For more information visit https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp

PRACTICE QUESTIONS

QUES 1 . With reference to the expenditure made by an organization or a company, which of the following statements is/are correct? UPSC 2022

1 . Acquiring new technology is capital expenditure.

2 . Debt financing is considered capital expenditure, while equity financing is considered revenue

expenditure.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: a

Nice 👍👍

Excellent work

Very informative