What is Money market?

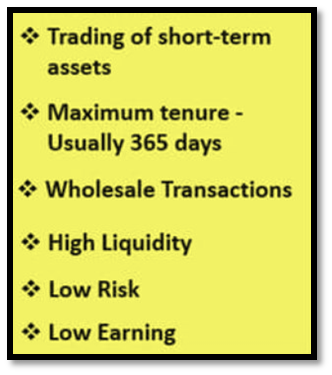

Money market refers to that part of the financial market where financial instruments with high liquidity and short-term maturities are traded.

Money market has become a component of the financial market for buying and selling of securities of short-term maturities, of one year or less, such as treasury bills and commercial papers.

Must read: Difference between Money Market and Capital Market

Why these markets are described as “money markets”?

These markets are described as “money markets” because the assets that are bought and sold are short term—with maturities ranging from a day to a year—and normally are easily convertible into cash.

The money market refers to the market for highly liquid, very safe, short-term debt securities. Because of these attributes, they are often seen as cash equivalents that can be interchangeable for money at short notice and thus the name “money” market.

Must read: What is Collateralized Borrowing and Lending Obligations (CBLO)?

Classification of Money Market

By definition, money market is for a maximum tenor of one year. Within the one year, depending upon the tenors, money market is classified into:

i. Overnight market – The tenor of transactions is one working day.

ii. Notice money market – The tenor of the transactions is from 2 days to 14 days.

iii. Term money market – The tenor of the transactions is from 15 days to one year.

Must read: Definition and Types of Money Market Instruments

What are the different Money Market Instruments?

Money market instruments include call money, repos, T- Bills, Cash Management Bills, Commercial Paper, Certificate of Deposit and Collateralized Borrowing and Lending Obligations (CBLO).

Significance of Money Market

The money market is crucial for the smooth functioning of a modern financial economy. It allows savers to lend money to those in need of short-term loans and allocates capital towards its most productive use. These loans, often made overnight or for a matter of days or weeks, are needed by governments, corporations, and banks in order to meet their near-term obligations or regulatory requirements. At the same time, it allows those with excess cash on hand to earn interest.

Advantages of Money Markets

֍ Extremely low risk.

֍ May be insured by agencies.

֍ They are highly liquid, meaning that they can readily be exchanged for cash at short notice.

֍ Higher returns than most bank accounts.

Disadvantages of Money Markets

֍ Low returns that may not keep pace with inflation.

֍ Not all money market securities are insured.

֍ May have high minimum investments or withdrawal restrictions.

For furthur information: External link: https://www.imf.org/external/pubs/ft/fandd/2012/06/basics.htm

PRACTICE QUESTIONS

QUES . With reference to the Indian economy, “Collateral Borrowing and Lending Obligations” are the instruments of: UPSC 2024

(a) Bond market

(b) Forex market

(c) Money market

(d) Stock market

Ans (c)