Must read: Know About IMF

What are the various lending instruments available with IMF?

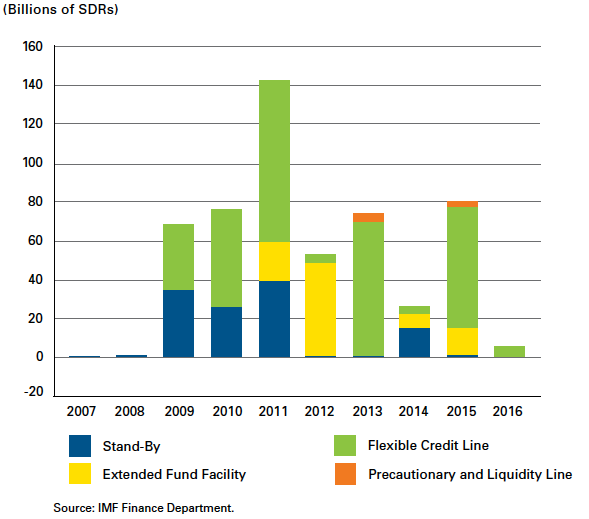

The IMF has several lending instruments to meet the different needs and specific circumstances of its members such as: Stand-by Arrangement (SBA) , Stand-by Credit Facility (SCF) , Extended Fund Facility (EFF) , Extended Credit Facility (ECF) , Rapid Financing Instrument (RFI) , Rapid Credit Facility (RCF) , Flexible Credit Line (FCL) , Short-term Liquidity Line (SLL) , Precautionary and Liquidity Line (PLL) , Resilience and Sustainability Facility (RSF) , Policy Coordination Instrument (PCI) , etc.

What is Stand-by Arrangement (SBA)?

The Stand-by Arrangement (SBA) provides short-term financial assistance to countries facing balance of payments problems.

Historically, it has been the IMF lending instrument most used by advanced and emerging market countries.

What is Stand-by Credit Facility (SCF)?

The Stand-by Credit Facility (SCF) provides financial assistance to low-income countries (LICs) with short-term balance of payments needs.

The SCF is one of the facilities under the Poverty Reduction and Growth Trust (PRGT).

What is Extended Fund Facility (EFF)?

The Extended Fund Facility (EFF) provides financial assistance to countries facing serious medium-term balance of payments problems because of structural weaknesses that require time to address.

To help countries implement medium-term structural reforms, the EFF offers longer program engagement and a longer repayment period.

What is Extended Credit Facility (ECF)?

The Extended Credit Facility (ECF) provides medium-term financial assistance to low-income countries (LICs) with protracted balance of payments problems.

The ECF is one of the facilities under the Poverty Reduction and Growth Trust (PRGT).

What is Rapid Financing Instrument (RFI)?

The Rapid Financing Instrument (RFI) provides prompt financial assistance to any IMF member country facing an urgent balance of payments need.

The RFI is one of the facilities under the General Resources Account (GRA) that provide financial support to countries, including in times of crisis.

What is Rapid Credit Facility (RCF)?

The Rapid Credit Facility (RCF) provides fast concessional financial assistance to low-income countries (LICs) facing an urgent balance of payments need.

The RCF is one of the facilities under the Poverty Reduction and Growth Trust (PRGT) that provide flexible financial support tailored to the diverse needs of LICs, including in times of crisis.

What is Flexible Credit Line (FCL)?

The Flexible Credit Line (FCL) is designed to meet the demand for crisis-prevention and crisis-mitigation lending for countries with very strong policy frameworks and track records in economic performance.

What is Short-term Liquidity Line (SLL)?

The Short-term Liquidity Line (SLL) is a liquidity backstop for members with very strong policy frameworks and fundamentals, who face potential, moderate, short-term liquidity needs because of external shocks that generate balance of payment difficulties.

It aims to minimize the risk of shocks evolving into deeper crises and spilling over to other countries.

What is Precautionary and Liquidity Line (PLL)?

The Precautionary and Liquidity Line (PLL) is designed to meet the liquidity needs of member countries with sound economic fundamentals but with some remaining vulnerabilities that preclude them from using the Flexible Credit Line (FCL).

What is Resilience and Sustainability Facility (RSF)?

The Resilience and Sustainability Facility (RSF) provides affordable long-term financing to countries undertaking reforms to reduce risks to prospective balance of payments stability, including those related to climate change and pandemic preparedness.

What is Policy Coordination Instrument (PCI)?

The Policy Coordination Instrument (PCI) is a non-financing instrument open to all IMF member countries.

It enables a closer dialogue with countries and the endorsement of policies by the IMF, which allows them to signal commitment to reforms and to catalyze financing from other sources.

What types of loans are provided by IMF?

The IMF provides loans on both non-concessional and concessional terms .

IMF members have access to the General Resources Account on non-concessional terms (market-based interest rates), but the IMF also provides concessional financial support (currently at zero interest rates) through the Poverty Reduction and Growth Trust, which is better tailored to the diversity and needs of low-income countries.

Reflecting different country circumstances and challenges, GRA-supported programs are expected to resolve the country’s balance of payments problems during the program period, while PRGT programs envisage a longer duration for addressing them.

What is the function of Resilience and Sustainability Trust?

The recently established Resilience and Sustainability Trust offers longer-term financing to low-income and vulnerable middle-income countries seeking to build resilience to external shocks at affordable interest rates.

The RST provides financing to address longer-term challenges, including climate change and pandemic preparedness.

What is Poverty Reduction and Growth Trust (PRGT)?

The IMF also provides concessional financial support to its low-income members through the Poverty Reduction and Growth Trust (PRGT), which has three lending facilities:

1 . Extended Credit Facility (ECF)

2 . Stand-by Credit Facility (SCF)

3 . Rapid Credit Facility (RCF)

Where are the IMF’s resources held?

The IMF’s resources are held in the General Department, which consists of three separate accounts: the General Resources Account (GRA), the Special Disbursement Account (SDA), and the Investment Account.

All IMF members have access to the General Resources Account on non-concessional loans.

External link: https://www.imf.org/en/About/Factsheets/IMF-Lending

PRACTICE QUESTIONS

QUES 1 . ‘’Rapid Financing Instrument’’ and ‘’Rapid Credit Facility’’ are related to the provisions of lending

by which one of the following? UPSC 2022

a) Asian Development Bank

b) International Monetary Fund

c) United Nations Environment Programme Finance Initiative

d) World Bank

Ans (b)

Very informative and helpful to us 🤩👍

Super 💯💯

Informative content