Inflation can be defined as too much of money chasing too few goods.

Causes of inflation https://fotisedu.com/causes-of-inflation/

Inflation – Measures of control https://fotisedu.com/inflation-measures-of-control/

Terminologies associated with inflation https://fotisedu.com/terminologies-associated-with-inflation/

The effects of inflation can be classified into two heads:

(1) Effects on Production and

(2) Effects on Distribution.

Effects on Production

When the inflation is very moderate, it acts as an incentive to traders and producers. This is particularly prior to full employment when resources are not fully utilized.

The profit due to rising prices encourages and induces business class to increase their investments in production, leading to generation of employment and income.

i) However, hyper-inflation results in a serious depreciation of the value of money and it discourages savings on the part of the public.

ii) When the value of money undergoes considerable depreciation, this may even drain out the foreign capital already invested in the country.

iii) With reduced capital accumulation, the investment will suffer a serious set-back which may have an adverse effect on the volume of production in the country. This may discourage entrepreneurs and business men from taking business risk.

iv) Inflation also leads to hoarding of essential goods both by the traders as well as the consumers and thus leading to still higher inflation rate.

v) Inflation encourages investment in speculative activities rather than productive purposes.

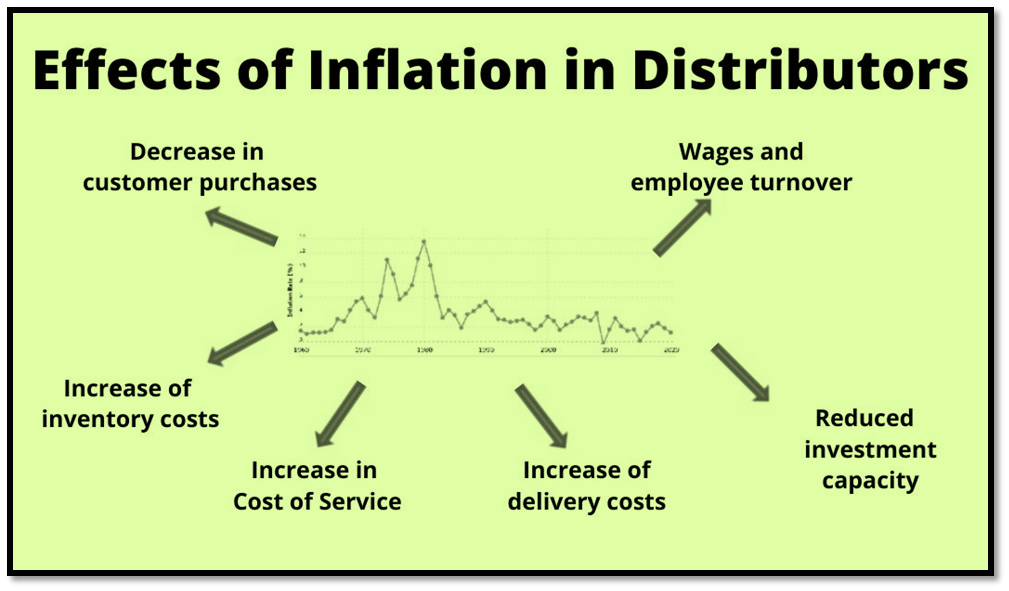

Effects on Distribution

i) Debtors and Creditors:

During inflation, debtors are the gainers while the creditors are losers. The reason is that the debtors had borrowed when the purchasing power of money was high and now repay the loans when the purchasing power of money is low due to rising prices.

ii) Fixed-income Groups:

The fixed income groups are the worst hit during inflation because their incomes being fixed do not bear any relationship with the rising cost of living. Examples are wage, salary, pension, interest, rent etc.

iii) Entrepreneurs:

Inflation is the boon to the entrepreneurs whether they are manufacturers, traders, merchants or businessmen, because it serves as a tonic for business enterprise. They experience windfall gains as the prices of their inventories (stocks) suddenly go up.

iv. Investors:

The investors, who generally invest in fixed interest yielding bonds and securities have much to lose during inflation. On the contrary those who invest in shares stand to gain by rich dividends and appreciation in value of shares.

For more information https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Inflation#:~:text=In%20an%20inflationary%20environment%2C%20unevenly,payers%20of%20fixed%20interest%20rates.

PRACTICE QUESTIONS

QUES 1 . Consider the following statements : UPSC 2013

(1) Inflation benefits the debtors.

(2) Inflation benefits the bond-holders.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: (a)