QUES . Describe the importance of crop insurance for small and marginal farmers in India. Write the role of insurance companies for crop insurance.

HINTS:

Every year, in one a part of India or the opposite food crops are suffering from natural calamities. The total loss due to natural calamities (like flood, drought and plant diseases) is estimated as high as Rs. 1,000 crores every year.

Crop insurance is crucial for small and marginal farmers in India as they are highly dependent on agriculture for their livelihoods and are vulnerable to risks such as crop failure due to natural calamities, pests, diseases, and other unforeseen events. Crop insurance provides financial protection to farmers by compensating them for losses incurred due to these risks.

Small and marginal farmers often lack access to financial resources to cope with crop losses, which can lead to debt, poverty, and even farmer suicides. Crop insurance can help reduce these risks and provide a safety net to farmers in times of need.

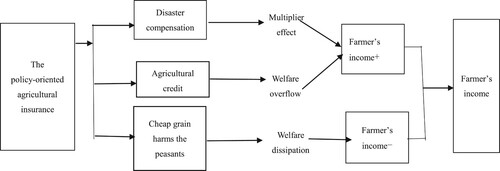

By protecting the economic interest of the farmers against possible risk or loss, it accelerates adoption of latest agricultural practices.

Insurance companies play a vital role in crop insurance by designing and offering insurance products, assessing risks, and paying claims. They use data and technology to assess the risk of crop failure, determine premiums, and settle claims efficiently. Insurance companies also work closely with farmers, governments, and other stakeholders to raise awareness about crop insurance and increase its adoption.

Insurance companies also help promote best practices and sustainable farming by providing advice and support to farmers on crop management and risk mitigation strategies. This helps farmers reduce the likelihood of crop failures and improve their overall productivity.

In summary, crop insurance is essential for small and marginal farmers in India, and insurance companies play a critical role in designing and delivering effective crop insurance products that can help farmers manage risks and build resilient livelihoods.