QUES . Discuss the evolution of international monetary system from collapse of the Bretton Woods arrangements in 1971. What are the features of present international monetary system?

HINTS:

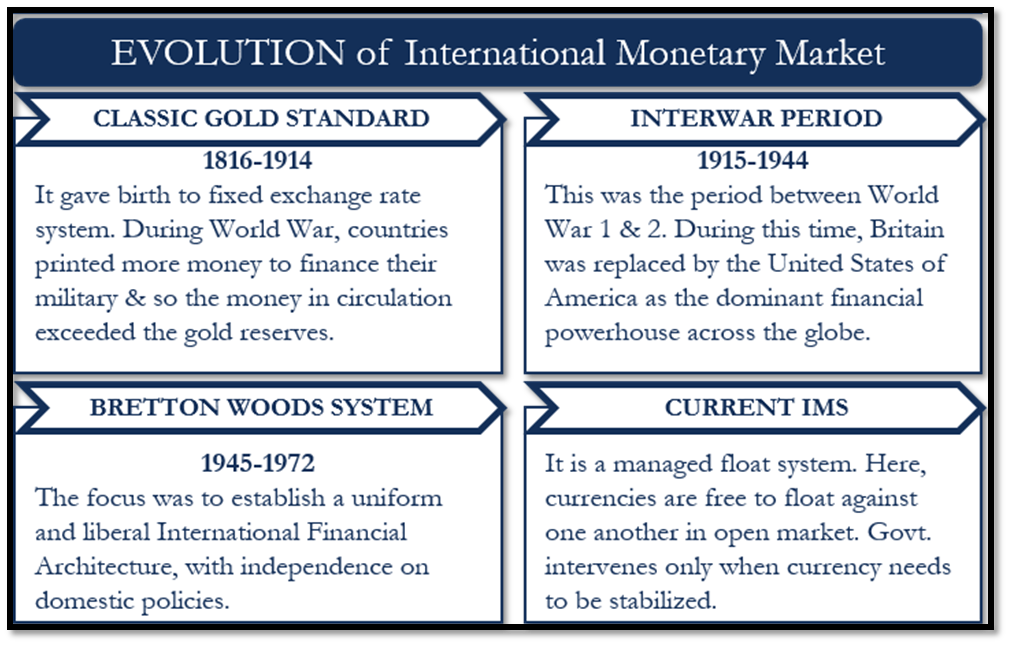

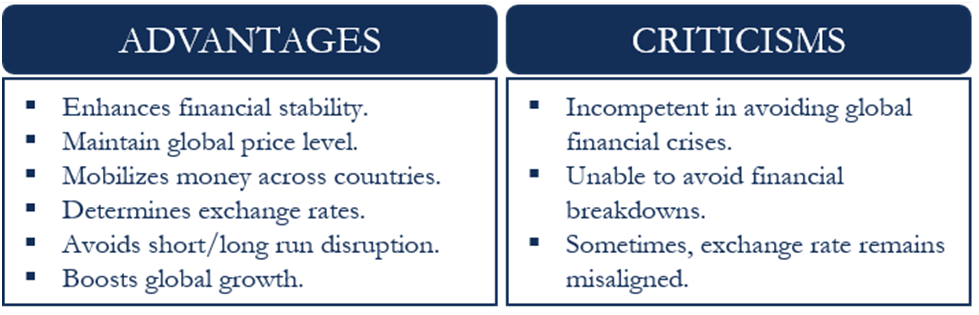

International Monetary System (IMS) is a well-designed system that regulates the valuations and exchange of money across countries. It is a well-governed system looking after the cross-border payments, exchange rates, and mobility of capital.

The collapse of the Bretton Woods arrangements in 1971 marked the beginning of the evolution of the international monetary system.

The Bretton Woods system, which had been established in 1944, was based on a fixed exchange rate regime, with the U.S. dollar serving as the international reserve currency. Under the system, other countries’ currencies were pegged to the U.S. dollar, and the U.S. dollar was pegged to gold at a fixed rate.

However, the U.S. faced significant balance of payments deficits, and by the late 1960s, the U.S. government had accumulated large amounts of debt, which made it difficult to maintain the fixed exchange rate system. In August 1971, the U.S. government unilaterally suspended the convertibility of the U.S. dollar into gold, effectively ending the Bretton Woods system.

After this, the international monetary system went through several stages of evolution, with the major features being:

Floating Exchange Rates: Following the collapse of the Bretton Woods system, most countries moved to floating exchange rates, where the value of a currency is determined by the market forces of supply and demand. In this system, countries do not target a specific exchange rate, but instead allow their currency to float freely.

Managed Floating Exchange Rates: Some countries, particularly emerging market economies, have adopted a managed floating exchange rate regime. Under this system, the central bank intervenes in the foreign exchange market to prevent excessive fluctuations in the exchange rate.

Increased Financial Integration: The international monetary system has become increasingly integrated, with financial markets becoming more interconnected. This has increased the speed and scale of international capital flows.

Emergence of Regional Currency Arrangements: Some countries have entered into regional currency arrangements, such as the Eurozone and the CFA franc zone in West and Central Africa. These arrangements involve a fixed exchange rate regime and a common currency.

Dominance of the U.S. Dollar: Despite the end of the Bretton Woods system, the U.S. dollar remains the dominant international reserve currency. Many countries still hold U.S. dollars as a reserve asset, and commodities such as oil are often priced in U.S. dollars.

The present international monetary system is characterized by a mix of floating and managed floating exchange rates, increased financial integration, and the dominance of the U.S. dollar. However, there is ongoing debate about the future of the international monetary system, with some experts advocating for the use of a new international reserve currency or the adoption of a new fixed exchange rate system.