The money market and the capital market are not single institutions but two broad components of the global financial system.

The money market is defined as dealing in debt of less than one year. Whereas the capital market is dedicated to the sale and purchase of long-term debt and equity instruments.

Must read: Money Market : Classification, Instruments, Significance, Advantages and Disadvantages

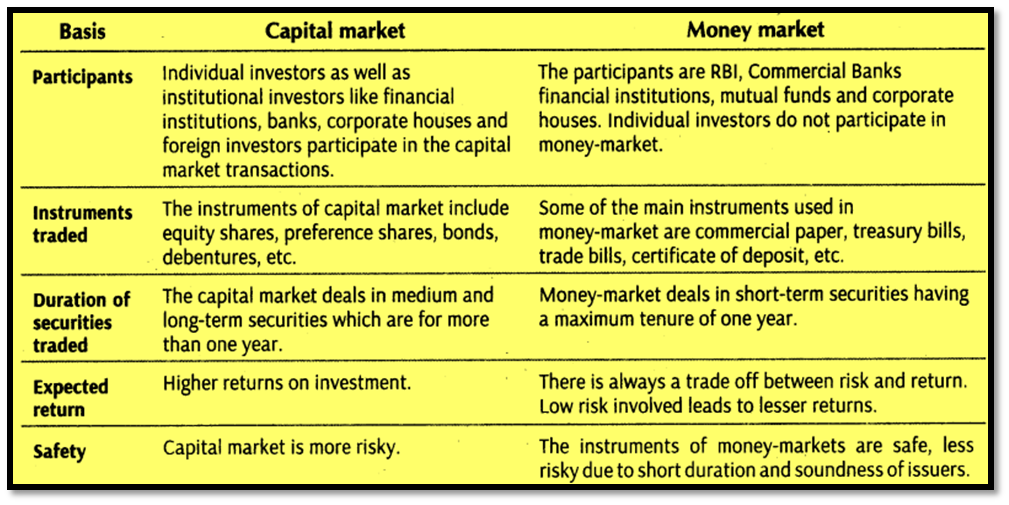

Money Markets vs. Capital Markets

Here is a side-by-side comparison of money markets and capital markets.

Use and significance

The money market is a short-term lending system. Borrowers tap it for the cash they need to operate from day to day. Lenders use it to put spare cash to work. Money market is primarily used by governments and corporations to keep their cash flow steady, and for investors to make a modest profit.

The capital market is geared toward long-term investing. Companies issue stocks and bonds to raise money to grow their businesses. Investors buy them to share in that growth.

Must read: Definition and Types of Money Market Instruments

Examples

Examples of money market instruments include certificates of deposit (CDs), commercial paper, Treasury bills (T-bills), and banker’s acceptances.

Capital markets can include the stock market, the bond market, and the forex market.

Risk

The money market is less risky, whereas the capital market has higher risk.

Investment yields

In money market generally there are lower investment yields. Whereas capital markets generally have higher investment yields.

Instruments

Money markets deal with short-term instruments that include Treasury bills, commercial paper, CDs, and bankers’ acceptances. Capital markets involve long-term financial instruments such as stocks and bonds.

Conversion to cash

In money markets it is easier to convert to cash. Whereas in capital market it is harder to convert to cash.

Participants

In money markets, the major participants include commercial banks, central banks, money market mutual funds, broker-dealers, and large corporations. These entities go to money markets because they need short-term funding.

In capital markets, there’s a broader range of users. Individual investors, institutional investors, pension funds, mutual funds, insurance companies, corporations, investment banks, or government entities may engage in capital markets. These participants invest in or issue long-term securities.

Must read: What is Collateralized Borrowing and Lending Obligations (CBLO)?

Degree of organization

Money markets are less structured whereas capital markets are more structured.

Regulation

Money markets are typically regulated by central banks (RBI in India) and other financial regulatory bodies to ensure stability.

Capital markets, however, are regulated by securities commissions and regulatory bodies such as the Securities and Exchange Board of India (SEBI).

Conclusion

Together, the money market and the capital market comprise a large portion of what is known as the financial market. Money markets and capital markets make the financial world go ’round.

For further information: External link: https://en.wikipedia.org/wiki/Capital_market