What is a budgetary deficit?

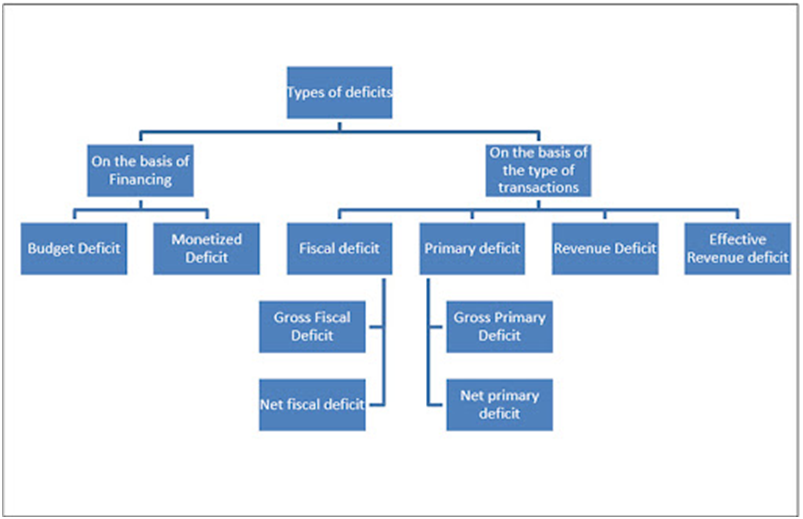

Budgetary deficit is the difference between all receipts and expenses in both revenue and capital account of the government.

Budgetary deficit is the sum of revenue account deficit and capital account deficit.

If revenue expenses of the government exceed revenue receipts, it results in revenue account deficit. Similarly, if the capital disbursements of the government exceed capital receipts, it leads to capital account deficit.

Must read: Fiscal Deficit: causes and how it can be reduced ?

Budgetary deficit is usually expressed as a percentage of GDP.

How to reduce a Budget Deficit?

There are only two ways to reduce a budget deficit , either (A) increase revenue or (B) decrease spending.

Must read: What is primary deficit and how it affects economy?

(A) Increase revenue: Governments can only increase revenue by raising taxes or increasing economic growth.

Tax increases are tricky. If they are too excessive, they will slow growth.

Must read: Participatory Budgeting: benefits and limitations

Increasing growth can only be done moderately. If growth is faster than the ideal range , it will create a boom, which leads to a bust.

(B) Decrease spending: Cutting spending also has pitfalls.

Must read: BUDGET TERMINOLOGY

Government spending is a component of GDP. If the government cuts spending too much, economic growth will slow. That leads to lower revenues and potentially a larger deficit.

The best solution is to cut spending on areas that do not create many jobs.

External link: https://cag.gov.in/uploads/download_audit_report/2009/Union_Compliance_Civil_Accounts_1_2009_Chap_5.pdf

PRACTICE QUESTIONS

QUES 1 . There has been a persistent deficit budget year after year. Which of the following actions can be taken by the government to reduce the deficit? UPSC 2015

1 . Reducing revenue expenditure

2 . Introducing new welfare schemes

3 . Rationalizing subsidies

4 . Expanding industries

Select the correct answer using the code given below.

(a) 1 and 3 only

(b) 2 and 3 only

(c) 1 only

(d) 1, 2, 3 and 4

Answer (a) 1 and 3 only EXPLANATION: ֍ Reducing revenue expenditure: Revenue expenditure like government employee salaries, administrative costs, subsidies etc. account for a major chunk of annual spending. Reducing this significantly lowers current expenditure, thereby directing lowering deficits without impacting development capital expenditure. ֍ Introducing new welfare schemes: While important for social welfare, new schemes entail substantial government spending on beneficiary coverage, operational costs etc. This bloats the expenditure side, increases fiscal deficit and interest obligations – hence counterproductive. ֍ Rationalizing subsidies: Review & optimization of subsidies across fuel, food, fertilizer areas to target only needy beneficiaries can save 10s of billions in wasteful subsidies annually. Lower subsidy payout directly reduces expenditure and lowers deficit. ֍ Expanding industries: While essential for growth & jobs, industry expansion does not check rising deficits directly. It expands production, tax revenues over the longer term. However, deficits are a short-term annual fiscal challenge requiring direct expenditure rationalization.

QUES 2 . There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit? UPSC 2016

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Answer (c) EXPLANATION: ֍ Reducing Revenue Expenditure: Revenue expenditure relates to recurring government costs like salaries, maintenance expenses etc. Reducing these large regular non-capital expenses is the most direct way to lower overall spending and hence fiscal deficit without hurting growth-focused capital investments. ֍ Introducing New Welfare Schemes: Additional schemes will expand the number of beneficiaries entitled to state support and subsidies. This will only bloat government expenditure further and increase the deficit. ֍ Rationalising Subsidies: Review and optimization of leakage-prone subsidies across sectors like fuel, fertilizers where lot of benefits leak to unintended beneficiaries. Plugging these gaps can generate major savings in wasteful spending every year, reducing expenditure and deficit. ֍ Reducing Import Duty: While this impacts trade balance positions, it does not address issue of high fiscal deficits driven by excess government expenditure over revenues.