QUES . What are the different types of agriculture subsidies given to farmers at the national and at state levels? Critically analyse the agricultural subsidy regime with reference to the distortions created by it. UPSC 2013 GS MAINS PAPER 3 200 words 10 marks

HINTS:

An agriculture subsidy is a governmental financial support paid to farmers and agribusinesses to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities. Agriculture subsidies act as an incentive to promote agricultural development and as an instrument of stimulating agricultural production and attaining self-sufficiency.

Major subsidies in India are fertiliser, power, credit, output, seed, and export subsidies. In 2021 Agri-subsidies were around 5 lakh crores as per NITI Aayog ( including food and fertiliser subsidies).

Types of agriculture subsidies

On the basis of mode of payment agriculture subsidies can be categorized into direct and indirect subsidies.

Direct subsidies

Direct subsidies are money transfers by the government that reach the ultimate beneficiary through a formal predetermined route. In the agriculture and allied sectors, subsidies are given for crop husbandry, agricultural implements, minor irrigation, soil conservation, horticulture, animal husbandry, pisciculture, sericulture and also for loss in agriculture during natural calamities like droughts or floods.

For example: Minimum support price (MSP), Fertilizer subsidy, Export promotion, Interest subsidy on agricultural loans like Kisan Credit Cards (KCC), Direct payment schemes like PM Kisan Samman Nidhi (PM-KISAN), etc.

Indirect subsidies

Indirect subsidies are provided through price reduction, welfare and other ways but do not include a direct cash payment. They reach the farmers along with the use of inputs. Therefore, these are highly correlated with the amount of use of inputs by farmers. Generally, those farmers who use more inputs would naturally enjoy higher subsidies.

For example: Crop insurance subsidy(Pradhan Mantri Fasal Bima Yojana), Irrigation subsidy, Power subsidy, Research and extension services,etc.

Issues related to agriculture subsidies

• The biggest of all the input subsidies in agriculture is the fertilizer subsidy. The subsidy policy in fertilizers has led to an imbalanced use of N, P and K in states like Punjab and Haryana which in turn contributes to deterioration of soil conditions. Subsidies induce excess use of fertilizers and pesticides in farm production.

• Agriculture subsidies draw marginal agricultural land into for agriculture production that might be used for forests, wetlands or other environmental conservation purposes.

• Subsidies given to the farmers for electricity, has resulted in drawing of ground water in huge excess. This has resulted in lowering of water table in many areas.

• In areas where there is a lack of sufficient electricity for agriculture, it encourages the private investment in diesel generating sets for agriculture and other purposes which is an underlying reason of huge petroleum imports. Thus, the fiscal deficit multiplies.

• Subsidies are paid from the public money. Corrupted politicians, bureaucrats, middlemen make the most of subsidies to their own benefit. Agricultural economy is marked with fodder scams, fertilizer scams, and diversion of funds.

• Agriculture subsidies induce excess production in some particular crops eg those having higher MSP, while some other crops are not produced in enough quantity to meet the demand and hence it causes food price inflation.

• The way subsidies in agriculture are being administered, food inflation will continue to be a concern for a long time and for the simple reason that the supply of non-cereal, protein-rich food items is not keeping pace with their increased demand.

• Subsidies also cause less insufficient attention to innovative agricultural practices such as mixed cropping, animal husbandry and cost control.

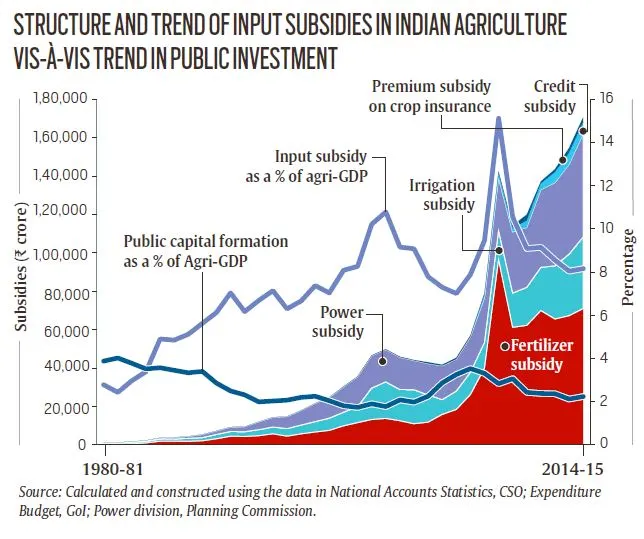

• The excess subsidies come at a cost of public investment in agriculture research, irrigation, rural roads and power. Lesser public investment in such areas due to more emphasis on subsidies further deteriorates the quality of essential services for rural areas like uninterrupted power supply.

Reasons in favour of the subsidies in agriculture

• Fertilizer subsidy is a development subsidy, which accelerate the fertilizer use and promotes agricultural production. Subsidies in fertilizer were reduced in the year 2003 and agricultural production gradually decreased as a result of that.

• The farmers are not able to purchase fertilizer on the higher price as production cost increases due to removal of agricultural subsidy. Thus, removal of subsidy would affect the agricultural sector and economy.

• Subsidies offer employment to unskilled workforce and contribute the human capital for agricultural needs. Government offers Minimum Support Prices (MSP) and provides facilities for proper warehousing and packaging facilities under agriculture subsidies.

• Seeds are distributed for subsidized rates and subsidies are also provided for farm mechanization to boost the agriculture productivity.

• Subsidies support seeds distribution, marketing facilities, farming techniques, new technology implementation and training methods, credit assurance, machinery, plant protecting, disaster management assured yearly crops to feed the every growing population.

Conclusion

There are research studies which show that the marginal returns evident in terms of poverty alleviation or accelerating agricultural growth are much lower than the input subsidies for agriculture development. There is trade-off between allocating money through subsidies for agriculture or increasing investments for agriculture development such as irrigation, backward infrastructure etc. The investment option is much better than subsidies for sustaining long-term growth in agricultural production and also to reduce burden on national exchequer.