What is a Farmer Producer Organisation (FPO)?

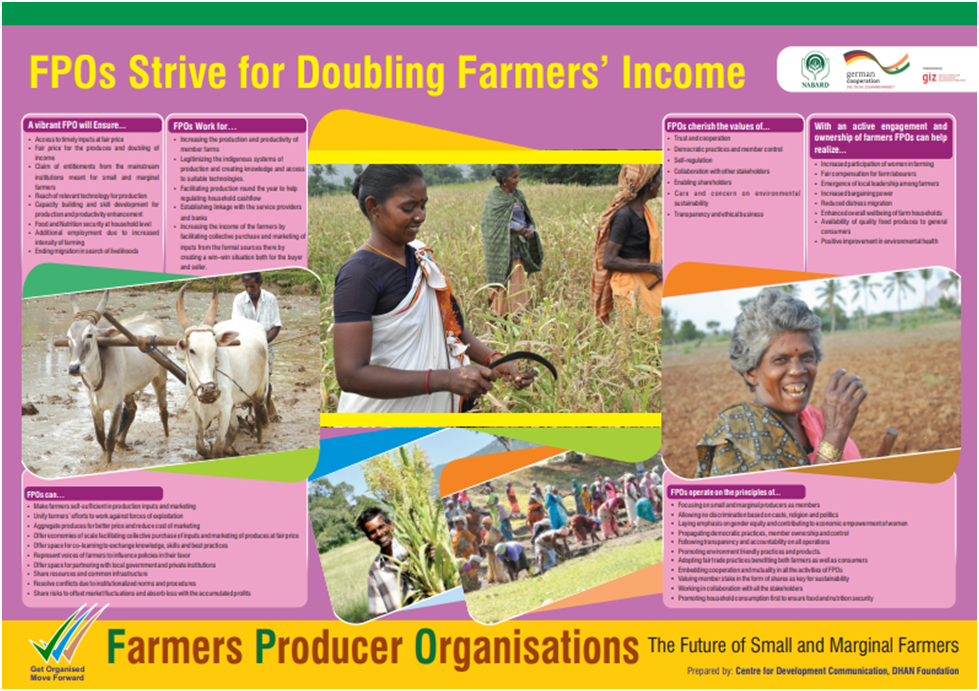

A Farmer Producer Organisation (FPO), formed by a group of farm producers, is a registered body with producers as shareholders of the organisation. It deals with business activities related to farm produce and works for the benefit of member producers.

What is the role and significance of Farmer Producer Organisation (FPO)?

֍With the majority of Indian farmers having small land holdings, FPOs encourage collective farming, addressing productivity challenges associated with limited farm size.

֍FPOs promote the modernization of agriculture, particularly benefiting small and marginal farmers who may lack access to modern equipment.

֍FPOs help reduce farmers’ costs through bulk purchases of inputs and enable better marketing of farm products. They aggregate produce and offer bulk transport solutions.

֍Farmers within FPOs have easier access to funds and support services from the government, donors, and service providers.

֍FPOs minimize post-harvest losses through value addition and efficient management of value chain facilities.

֍FPOs empower farmers by enhancing their bargaining power and income levels, enabling them to compete with large corporate enterprises.

֍FPOs play a crucial role in eliminating non-transparent intermediaries in agricultural marketing, leading to better incomes for farmers.

֍FPOs provide access to modern technologies, credit, capacity-building, and training, and ensure traceability of agricultural produce. Traceability is the ability to identify the origin of food and the feed ingredients in a supply chain.

֍FPOs are enhancing local diets by developing the value chain of nutrient-rich agri-products like millets, mushrooms, moringa, and fortified cereals.

֍FPOs facilitate the collectivization of small, marginal, and landless farmers, giving them collective strength to address issues like crop failure and market access.

֍FPOs enable efficient communication for disseminating information about prices, volumes, and other farming-related advisories.

֍Practices like contract farming and agreements, enabled by FPOs, help manage price fluctuations.

What are the problems faced by Farmer Producer Organisation (FPO)?

֍Credit guarantee schemes require FPOs to have a minimum of 500 shareholder members, leaving many small FPOs without access to credit benefits.

֍FPOs struggle with limited connections to industry players, large retailers, and other market participants.

֍FPOs primarily comprise small and marginal farmers with limited resources, hindering their ability to provide quality products and services initially.

֍Existing insurance schemes cover production risks for farmers but do not address business risks for FPOs.

֍Farmers often lack awareness of the benefits of collective farming, and there is a shortage of competent agencies to provide support.

֍Lack of or inadequate professional management. There are thousands of FPOs in the country but only a few are successful and are making money. In an FPO, business competence will develop when you have corporate skills and leadership . But most of the FPOs depend on Government programs and have no business acumen.

֍FPOs lack essential facilities like transport, storage, value addition, processing, brand building, and marketing.

Conclusion

Today the number of small and marginal farmers are rising in the country. To support such farmers, FPOs could be useful. But merely establishing the FPOs will not work, as it requires a good ecosystem to operate. These organisations face challenges such as funding, capacity building and value chain investments. Domestic policies and laws also needed to be addressed for growing the FPOs.

The success of FPO will also depend on other players such as Banks, Retailers and Corporate sector. The value chain required for the development of FPOs cannot be done by one player.