QUES . What changes has the Union Government recently introduced in the domain of Centre-State relations? Suggest measures to be adopted to build the trust between the Centre and the States and for strengthening federalism. Answer in 250 words.15 marks. UPSC MAINS 2024. GS PAPER 2

HINTS:

The Union Government has introduced various changes in the domain of Centre-State relations to enhance cooperation and promote cooperative federalism. The recent changes aim to address economic, administrative, and political aspects, but they have also raised concerns about potential centralization of power at the Centre.

Must read: Indian federalism is moving from co-operative federalism to competitive federalism

Recently Introduced Changes in the Domain of Centre-State Relations

Goods and Services Tax (GST):

The implementation of GST and the establishment of the GST Council have aimed to create a unified indirect tax regime through cooperative decision-making between the Centre and states. However, it has affected the financial autonomy of states and their revenue generation capabilities.

Must read: Issues and Challenges in Centre-State Financial Relations and Fiscal Federalism

With the advent of GST, the states lost their rights to increase tax revenues by changing the tax rates on sale of many goods and services. (GST rates and slabs are decided by the GST council with 3/4th majority vote).

Financial Devolution:

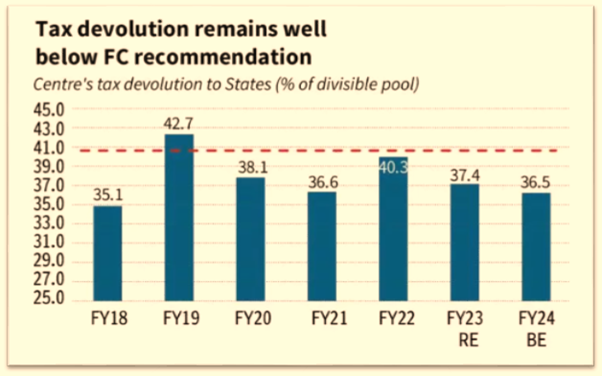

As per the 15th Finance Commission (2021–2026), 41% of the central tax pool is allocated to states, ensuring more resources for state-level initiatives. But the actual tax devolution remains well below Finance Commission recommendation.

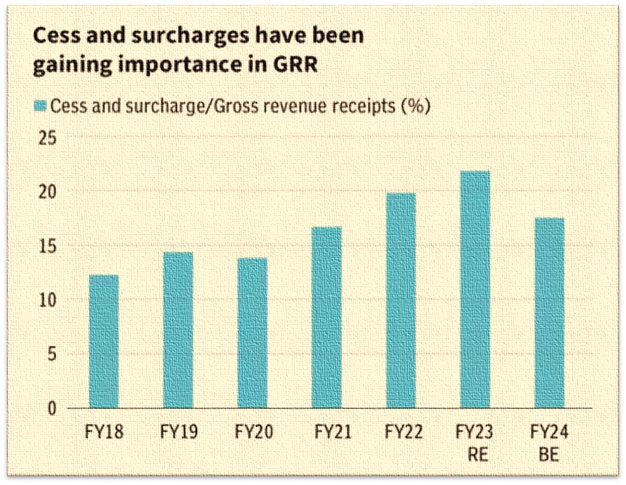

Also, over the last few years, the central government has reduced the tax rates and increased the cess and surcharges which are not mandated to be shared with the states. Cess and surcharges are part of central taxes but not part of the divisible tax pool and do not have to be shared with States.

Amendments to All India Services Rules:

Recent changes in policies regarding the deputation and transfer of IAS, IPS, and IFoS officers have granted the Centre increased control, potentially undermining state administrative autonomy.

National Education Policy (NEP) 2020:

It sets national framework for education. However, Some states expressed concerns over uniform national policy that may not consider regional and linguistic diversity, thereby affecting state autonomy in framing educational policies.

Restructuring of Centrally Sponsored Schemes:

Rationalization of these schemes has altered funding patterns and implementation processes, impacting state-level development initiatives and priorities.

Must read: Evolving Pattern of Centre-State Financial Relations

NITI Aayog’s Role:

As a successor to the Planning Commission, NITI Aayog has redefined planning and policy coordination, emphasizing a more collaborative approach but also altering traditional Centre-State dynamics.

Direct Benefit Transfer (DBT) Scheme:

By centralising welfare disbursement through the Direct Benefit Transfer, Centre has reduced state control over social welfare programs, which could lead to a lack of responsiveness to local conditions.

The Proposed One Nation, One Election:

The proposal for simultaneous elections across Lok Sabha and State Assemblies has sparked debate, with several states arguing that this undermines the federal structure.

Must read: One Nation, One Election : a Critical Analysis

Measures to Build Trust Between Centre and States and for Strengthening Federalism

Strengthening Centre-state institutions:

Institutions such as the Inter-State Council, Finance Commission, and Niti Aayog need to be strengthened to ensure a smooth relationship between the Centre and states. Meetings of Inter-State Council should be convened to discuss and address Centre-State issues, ensuring all states have a platform for their concerns.

Must read: ‘Principle of Federal Supremacy’ and ‘Harmonious Construction’

Promoting Fiscal Federalism:

The Centre and states should work towards promoting fiscal federalism to ensure equitable distribution of resources. Regularly review GST implementation based on state feedback to ensure fairness and effectiveness in revenue sharing. Ensure prompt disbursement of states’ shares in central taxes and grants to support their financial health.

Room for States on Concurrent Subjects:

The Union should occupy only that much field of a concurrent subject on which uniformity of policy is needed and leave the rest for state action. (Sarkaria Commission recommendation,1983).

“Management of Disasters and Emergencies, Natural or Man-made” should be included in the Concurrent List of the Seventh Schedule. (National Commission to Review the Workings of the Constitution, NCRWC, 2000 recommendation).

Cooperative Federalism:

Involve states in the formulation of national policies, ensuring their interests and concerns are adequately represented. Uphold state autonomy in subjects listed under the State List, fostering a more respectful relationship.

Avoiding the ‘One size fits all’ approach to promote cooperative federalism and recognising the diversity of the States in terms of their socio-economic, political, and cultural contexts.

Reform the Role of Governors:

Establish transparent guidelines for the appointment and functions of Governors to minimize political interference. Ensure Governors act impartially as a link between the Centre and States, fostering trust.

A fixed five-year tenure for Governors and their removal only through impeachment by the state Assembly along the same lines as that of the President by the Parliament. (MM Punchhi Commission, 2007 recommendation)

Empower Local Self-Governance:

Enhance the capacities of Panchayati Raj Institutions and urban local bodies to ensure effective local governance. Ensure proper devolution of funds, functions, and functionaries to empower local bodies in decision-making.

The scope of devolution of powers to local bodies to act as institutions of self-government should be constitutionally defined through appropriate amendments. (MM Punchhi Commission, 2007 recommendation)

Strengthening All-India Services:

The institution of All-India Services should be strengthened, and more such services should be created.(Sarkaria Commission recommendation,1983)

Establishment of Inter-State Trade and Commerce Commission:

In accordance with Article 307, the Inter-State Trade and Commerce Commission should be established as a legislative body. (National Commission to Review the Workings of the Constitution, NCRWC, 2000 recommendation).

Conclusion

The recent changes reflect both positive initiatives as well as challenges in Centre-State relations. To build trust and strengthen federalism, continuous dialogue, cooperation, and mutual respect are imperative between both levels of government.