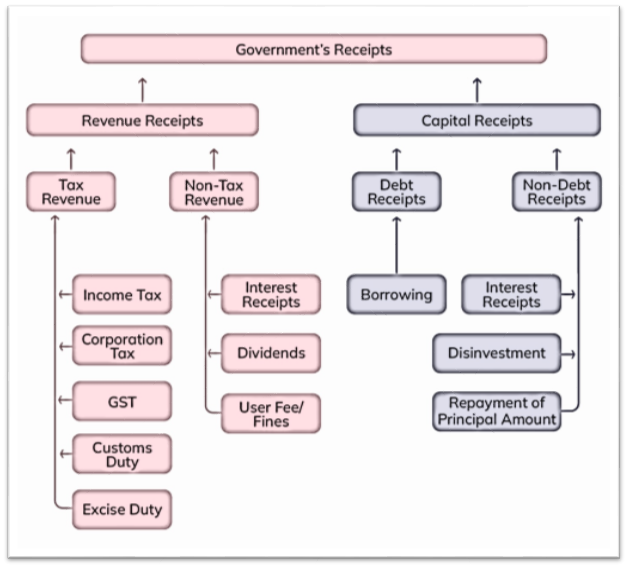

The Union Budget, which is presented by the Finance Minister of India, comprises Capital Budget and Revenue Budget. The Capital Budget is further categorised into capital receipts and capital expenditure.

What are Capital Receipts?

Capital receipts are receipts that create liabilities or reduce financial assets. They also refer to incoming cash flows. Capital receipts can be both non-debt and debt receipts.

Must read: BUDGET TERMINOLOGY

Capital receipts are loans taken by the government from the public, borrowings from foreign countries and institutes, and borrowings from the RBI. Recovery of loans given by the Centre to states and others is also included in capital receipts.

In the balance sheet, capital receipts are mentioned in the liabilities section. The capital receipt has a nature of non-recurrence. All capital receipts are tax-free, unless there is a proviso to tax it.

What are Non-Debt Capital Receipts?

Non-debt receipts are those which do not incur any future repayment burden for the government. Almost 75 per cent of the total budget receipts are non-debt receipts.

Examples of Non-Debt Capital Receipts:

Recovery of loans and advances

Disinvestment

Issue of bonus shares, etc.

What are Debt Capital Receipts?

Debt Receipts have to be repaid by the government. Around 25 per cent of government expenditure is financed through borrowing.

A reduction in debt receipt (or borrowing) can be a big leap for the economy’s financial health. Most of the capital receipts of the government are debt receipts.

Examples of Debt Capital Receipts:

Market loans

Issuance of special securities to public-sector banks

Issue of securities

Short-term borrowings

Treasury bills

Securities against small savings

State provident funds

Relief bonds

Saving bonds

Gold bonds

External debt, etc.

PRACTICE QUESTIONS

QUES . Consider the following statements: UPSC 2025

I. Capital receipts create a liability or cause a reduction in the assets of the Government.

II. Borrowings and disinvestment are capital receipts.

III. Interest received on loans creates a liability of the Government.

Which of the statements given above are correct?

(a) I and II only

(b) II and III only

(c) I and III only

(d) I, II and III

Answer (a) EXPLANATION: Non-tax revenue receipts of the central government mainly consist of interest receipts on account of loans by the central government, dividends and profits on investments made by the government, fees and other receipts for services rendered by the government. They do not create liability. Hence statement III is not correct.