What is Public debt?

Public debt is the total liabilities of the central government contracted against the Consolidated Fund of India.

As the name suggests, public debt occurs when the government’s revenue from taxes and other sources falls short of its spending requirements and has to resort to borrowing from markets and external sources.

The public debt of the Government of India is composed of :

(a) internal debt and (b) external debt.

What is internal debt?

Internal debt is categorised into marketable and non-marketable securities.

Marketable government securities include G-secs and T-Bills issued through auction.

Non-marketable securities include intermediate treasury bills issued to state government’s, special securities issued to national Small Savings Fund among others.

What is External debt?

External debt figures represent borrowings by Central Government from external sources and are based

upon historical rates of exchange.

What is the size of Public Debt?

The size of the government debt is important as a sizeable chunk of annual payments (around 25 per cent) is just the interest cost for the past debt. The central government’s debt stood at Rs 171.78 lakh crore or 58.2 per cent of the GDP at the end of March 2024.

Public debt is categorized based on repayment duration: short-term debt (repayable within one year), medium-term debt (1–10 years), and long-term debt (around 10 years).

Does household financial savings goes towards government borrowings?

Deposits with banks are the single largest form of households’ financial assets, followed by insurance funds, mutual funds and currency. As insurance companies and mutual/provident funds are key investors in government securities, a share of the household financial savings goes towards government borrowings.

50.8% of households’ savings in FY18 were in financial assets, followed by physical assets (48.1%) and gold/silver ornaments (1.1%).

How the total outstanding liabilities of Government of India is calculated?

Total outstanding liabilities of Government of India is equal to the addition of

(1) Internal liabilities + (2) External debt

where Internal liabilities is equal to :

Internal debt plus Other internal liabilities https://www.indiabudget.gov.in/economicsurvey/doc/stat/tab25.pdf

Significant points may be noted as regards the public debt of India since 1950-51:

Is the purpose of borrowing has changed?

Initially , the Central Government borrowed mainly for financing development schemes.

What is really alarming now is that the Central Government is forced to borrow even to meet its current revenue expenditure .

In other words , the Government has been living beyond its means .

External debt as per cent of the total debt and other liabilities is increasing

External debt had increased from 1.0 per cent of the total debt and other liabilities of the Central

Government in 1950 -51 to more than 3 percent now .

The increase in the share of external debt is explained by the rapid rate at which external assistance had been obtained and utilised in recent years .

By far the largest share of India’s external debt is provided by the United States of America . Dollar loans constitute over 30 percent of India’s external debt.

Public debt of the Government of India is increasing

The public debt of the Government of India had increased from Rs. 2,054 crores in 1950-51 to :

Rs. 10,80,300 crores in 2002-03

Rs. 37,43,658 crores in 2012-13

Rs 159.53 lakh crore at June-end 2023

The public debt accounted for 89.5 per cent of total gross liabilities at June-end 2023.

Total public debt and other liabilities is on rise

The total public debt and other liabilities of the Indian Government was Rs. 50,25,072 crores by end March 2012 ; it was only Rs. 2,30,000 crores in March 2003 .

On 31st March 2023 the total public debt and other liabilities of the Indian Government was Rs.152,61,122 crores.

Other internal liabilities

In addition to the public debt , the Government of India has certain other liabilities for instance , the

Government owes to the general public for funds raised through small savings schemes , provident funds , deposits under the Compulsory Deposit Schemes , Income Tax Annuity Deposit Schemes , Reserve Funds of the Railways and Posts and Telegraphs , etc .

All these constitute the “other” liabilities of the Central Government .

The Government has to pay interest on its other liabilities – often quite high as in the case of public provident fund . The Central Government’s other liabilities have also been increasing ,as for example :

Rs. 511 crores in 1950-51

Rs. 4,78,600 crores in 2002-03

Rs. 12,44,081 crores in 2013-14

Rs 15,78,257 crores in 2022-23

Total outstanding liabilities as per cent of GDP

The outstanding liabilities of the Central Government , comprising internal and external liabilities , as

a proportion of GDP were 55 percent in 1990- 91 : It showed a declining trend till 1998-99 when it touched 51 percent.

In 2013-14 it was 50.5%.

In 2022-23 it was 59%.

The outstanding internal and external debt and other liabilities of the Government of India is estimated to 168,72,554.17 crore at the end of 2023-2024.

The increasing trend in internal liabilities is a matter of serious concern . This has not only raised the interest burden but also raised concerns about the sustainability of the growing internal debt .

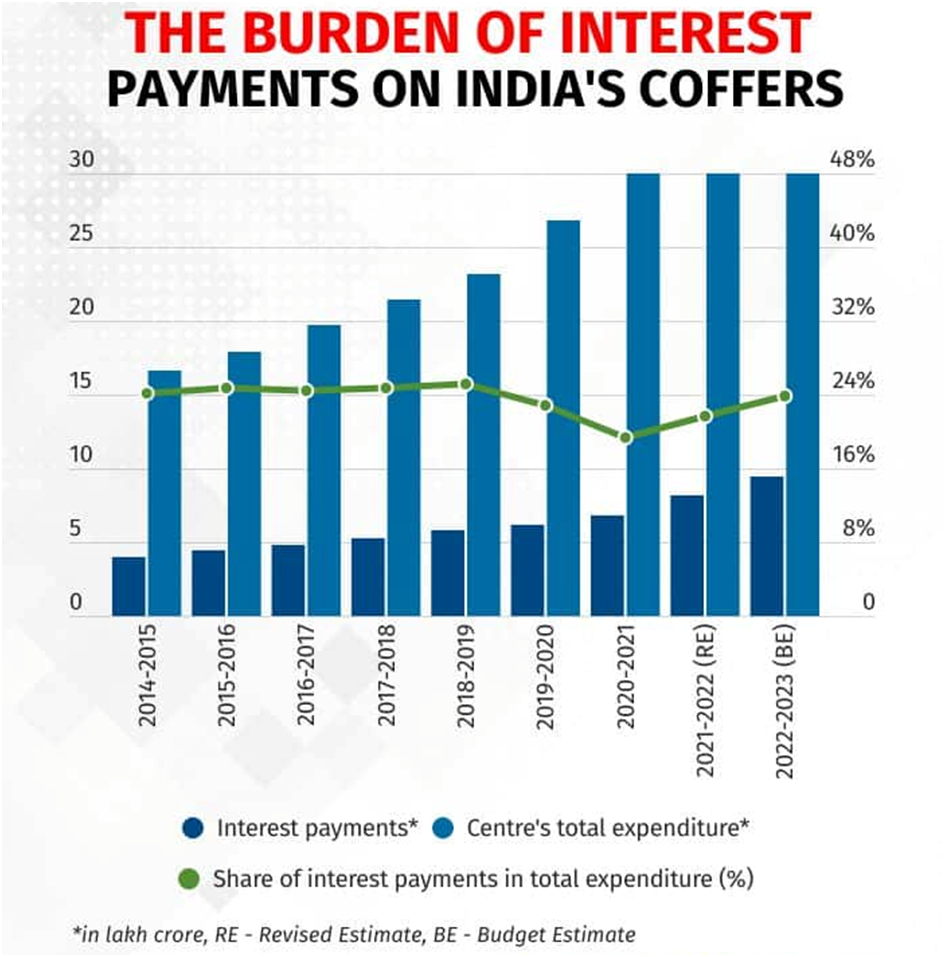

Burden of servicing of public debt

The burden of servicing of public debt and other liabilities is becoming heavier with every passing year.

Interest payment of the Centre was Rs. 90,250 crores in 1999-2000.

In 2014-15, the Centre paid out Rs 4.02 lakh crore as interest on its debt.

While this increased steadily, as would be expected, the last three years have seen a sharp increase in these payments – both in absolute terms as well as a fraction of expenditure.

In 2021-22, the Centre spent Rs 8.14 lakh crore on interest payments, amounting to 21.6 percent of its total expenditure for the year and 39.1 percent of the revenue receipts.

Expenditure on interest payment in 2024-25 is estimated to be Rs 11,90,440 crore, which is 25% of the government’s total expenditure.

External debt to GDP ratio

What does debt-to-GDP ratio indicates?

The debt-to-GDP ratio indicates how likely the country can pay off its debt. Investors often look at the debt-to-GDP metric to assess the government’s ability to finance its debt.

Higher debt-to-GDP ratios have fuelled economic crises worldwide. The European debt crisis was a result of excessive debt piled up on government books which became unsustainable.

It is often important to see the nature of government’s deficit. Whether the government is borrowing more for creating capital assets or on subsidies and other expenditure which doesn’t result in the creation of any asset. Capital spending by the government especially during a slowdown helps in crowding in private investment.

India’s External Debt as percentage of Nominal GDP data is updated yearly, available from Mar 1970.

The data reached an all-time high of 38.2 % in Mar 1992 and a record low of 10.9 % in Mar 1980.

The valuation effect of US dollar and other major currencies also plays an important role on the external debt of the country. Valuation efects are the changes in value of assets held abroad with regard to the value of domestic assets held by foreign investors.

Is there an acceptable level of debt-to-GDP?

The NK Singh Committee on FRBM had envisaged a debt-to-GDP ratio of 40 per cent for the central government and 20 per cent for states aiming for a total of 60 per cent general government debt-to-GDP.

What is the present status of external debt to GDP ratio?

The external debt to GDP ratio stood at 18.7 % at end March 2024. This includes both government and non-government debt. Of this, government debt accounted for 4.2% of GDP, while non-government external debt stood at 14.5%. The external debt stood at $663.8 billion at the end of March 2024.

Commercial borrowings, Non-Resident Indian (NRI) deposits, short-term trade credits and multilateral loans together accounted for 89.6 per cent of the total external debt of India at end March 2024.

External debt comprises loans (multilateral and bilateral credits and bank loans) accounting for 33.4% of total $663.8 billion. Other major components include currency and deposits 23.3% , trade credits 17.9% and debt securities 17.3%.

Dollar-denominated debt remained the largest component of the external debt, with a share of 53.8% by March-end, followed by debt denominated in rupee (31.5%), yen (5.8%), SDR (5.4%) and the euro (2.8%).

Rupee denominated debt is composed of outstanding state credits (both defence and civilian) extended to India by the erstwhile Union of Soviet Socialist Republic (USSR); rupee-denominated NRI deposits; foreign portfolio investor’s (FPI) investments in treasury bills (TBs) and dated securities; and FPI investments in corporate debt securities.

Short-term debt constituted 20.6 per cent of the total external debt of India at end March 2024.

Must read: Raising capital for business – Equity vs Debt Financing

PRACTICE QUESTIONS

QUES 1 . With reference to the Indian economy, consider the following statements: UPSC 2022

1 . A share of the household financial savings goes towards government borrowings.

2 . Dated securities issued at market-related rates in auctions form a large component of internal

debt.

Which of the above statements are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: (c)

QUES 2 . Consider the following statements: UPSC 2019

(1) Most of India’s external debt is owed by governmental entities.

(2) All of India’s external debt is denominated in US dollars.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: (d)

Excellent work

Nice

Very good 👍👍👍

Great work