What is peer-to-peer lending?

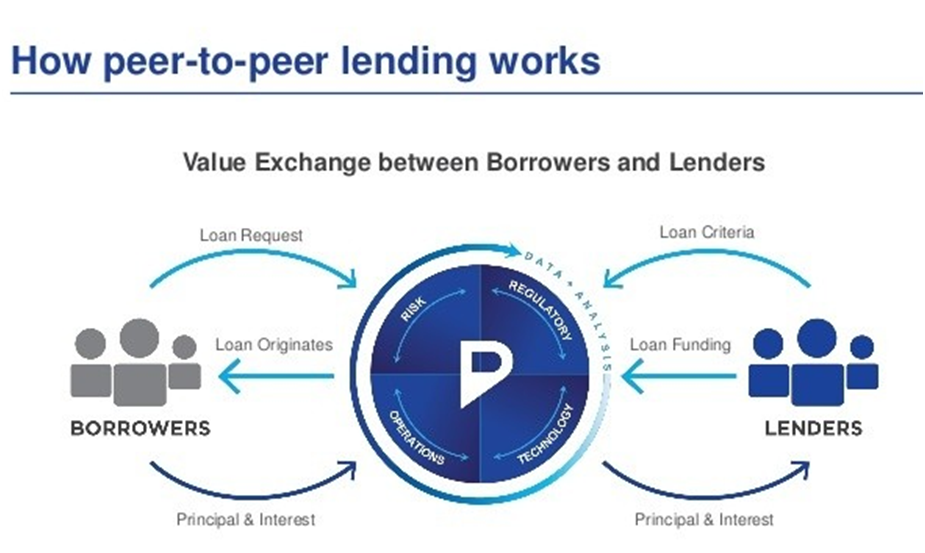

P2P lending is a form of crowd-funding used to raise loans which are paid back with interest by bringing together people who need to borrow, from those who want to invest.

It can be defined as the use of an online platform that matches lenders with borrowers to provide unsecured loans. The borrower can either be an individual or a legal person requiring a loan. The interest rate may be set by the platform or mutual agreement between the borrower and lender.

How peer-to-peer lending works?

Non-Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017

The Reserve Bank of India (RBI) in the year 2017 issued directions for non-banking financial companies (NBFC) that operate peer-to-peer (P2P) lending platforms. According to the directions, from now on, no NBFC can start or carry on the business of a P2P lending platform without obtaining a Certificate of Registration. Every company seeking registration with the bank as an NBFC-P2P shall have a net owned funds of not less than Rs 20 million or such higher amount as the bank may specify.

What is the scope of activities of NBFC-peer-to-peer lending?

Among several other things, an NBFC-P2P can:

(i) Act as an intermediary providing an online marketplace or platform to participants involved in P2P lending.

(ii) Not raise deposits as defined by or under Section 45I(bb) of the Act or the Companies Act, 2013.

(iii) Not lend on its own.

(iv) Not hold, on its own balance sheet, funds received from lenders for lending, or funds received from borrowers for servicing loans.

(v) Not cross-sell products except for loan-specific insurance products.

(vi) Not permit international flow of funds.

An NBFC-P2P will be expected to:

(i) Undertake due diligence on the participants.

(ii) Undertake credit assessment and risk profiling of the borrowers and disclose the same to their prospective lenders.

(iii) Undertake documentation of loan agreements and other related documents.

(iv) Provide assistance in disbursement and repayments of loan amount.

(v) Render services for recovery of loans originated on the platform.

What are the prudential norms associated with NBFC-peer-to-peer lending?

(1) The aggregate exposure of a lender to all borrowers at any point of time, across all P2Ps, shall be subject to a cap of Rs 10 lakh.

(2) The aggregate loans taken by a borrower at any point of time, across all P2Ps, shall be subject to a cap of Rs 10 lakh.

(3) The exposure of a single lender to the same borrower, across all P2Ps, shall not exceed Rs 50,000.

(4) The maturity of the loans shall not exceed 36 months.

What are the risks associated with P2P lending?

There are no legally defined disclosure standards to ensure that lenders have a clear and accurate understanding of the risks associated with using a specific P2P platform.

The methods used for calculating the risk-adjusted net returns differ considerably from platform to platform because national laws and regulators have yet to define a common standard for measuring the performance of P2P-loan investments.

There are no disclosure standards for information about borrowers or platforms’ credit assessment methods. This makes it impossible for investors to assess and compare the quality of platforms and so make a careful selection of the “right” platform.

There is lack of transparency about how platforms assess credit. Borrowers may not know what kind of data their platforms are using and how credit ratings are calculated.

Often platforms in countries without dedicated crowdfunding regulation do not need any central authorisation from the national financial regulator to start their business and do not have to fulfil minimum capital requirements

What are the opportunities associated with P2P lending?

Surveys of P2P borrowers reveal that the convenience of using a web-base to get credit is the highest ranked benefit of P2P-lending.

The advantages are seen mainly as lower transaction costs in the loan application process and a much shorter time span, when compared to bank loans, from first contact until the loan pay-out is received. Lower transaction costs are a result of 24/7 accessibility of the platform, reduced bureaucracy and documentation requirements, and a simple and transparent application process.

Corporate borrowers have the ability to obtain P2P-loans without providing collateral.

Due to low administration cost, P2P is able to provide cheaper credit than banks.

Most platforms allow borrowers to cancel loan contracts prematurely without paying a prepayment penalty.